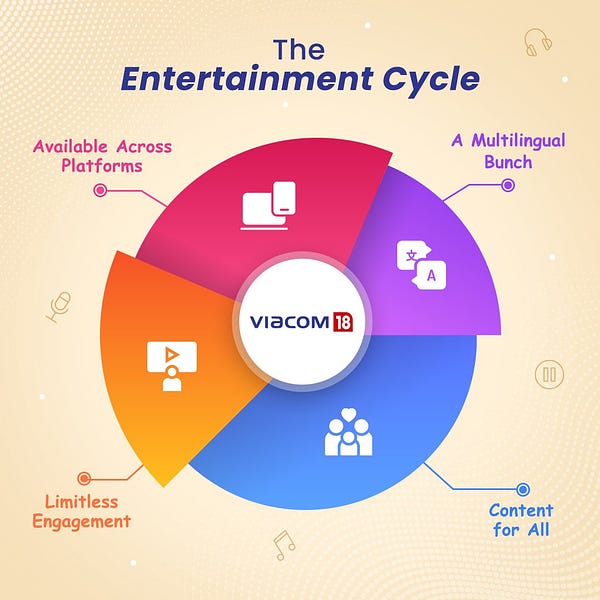

$6 Billion for Cricket?! Jiminy! Why?Maybe Disney and Amazon 'let' Viacom win in India as 'marginal benefit' in the new streaming economy becomes realGrab your cricket bats, set up your wickets and get ready to bowl, because today we’re talking cricket! Cricket, it turns out, could explain the future of the (sports) streaming wars. As various philosophers and historians have quipped over the years — though tracking down exactly who said it when is complicated — history may not repeat itself, but it rhymes. I’d apply this to the streaming wars: what happens in different countries maybe not be the exact same, but it will rhyme. That’s why, for this week’s column, we’re traveling halfway around the globe to talk about the big story: the Indian Premiere League, a cricket league which sold its Indian linear and streaming rights to Disney’s Hotstar and Viacom18 respectively. (And so you know my preferences, I’d say IPL rights are at least as important to the future of streaming as say, the ouster of a major TV exec at a certain studio. But while the latter got roughly 4,500 articles and newsletters written about it, the IPL only received a handful of write-ups.) This outcome is a pinch of a shocker, since Disney’s Hotstar had previously owned both linear and streaming rights, and now they've lost the streaming rights. A good chunk of Disney+’s subscribers are based in India, and those subscribers seem to watch a lot of cricket. In the company’s last earnings call in May, Disney’s CFO Christine McCarthy said 36 percent of the 137.7 million overall Disney+ subscribers were from Disney+ Hotstar, the name of Disney’s Indian streaming service. A little more than half of the subscribers who signed up for Disney+ (8 million in the last quarter) were from, yep, Disney+ Hotstar. So let’s explain what happened, what motivated each of these companies (to either try to win or hold back), and what this could mean for U.S. and global sports rights. Viacom18 — a recently expanded traditional and streaming joint venture between Paramount Global, Bodhi Tree Systems and Reliance — won the rights for streaming of the IPL in India for a whopping $3 billion. (Disney’s Hotstar only retained broadcast rights in India for another $3 billion.) It won because it had the most to gain, whereas the bigger streamers are starting to question the value of losing money to grow streaming services in India (pre-2022, that rapid growth no matter the profits made a great fast-talking headline out of earnings calls for Wall Street). If that trend continues in the rest of the world, the streaming wars as we know them could look much different over the next five to 10 years. The News: What Is It?If you’re based in the U.S., you probably don’t know what the IPL is. I’d describe it like a mixture of the MLS and the NFL. It resembles Major League Soccer because it’s relatively young — the league only started in 2008 — and the NFL because it’s already one of the biggest sports leagues in India. (And the world’s biggest cricket league.) The key innovation was to focus on a shorter form of cricket — a two-hour match called Twenty20 Cricket — and then the IPL imported some innovations from other leagues, like NFL-style, city-based teams. (The Economist had a good explainer a few months back.) This 10-minute explainer from CNBC is also pretty good:  In India, the rights for this new league have become the hot thing. A lot of folks credit Disney+’s growth in India to its merger with 20th Century Fox, owner of Hotstar, which had a five-year deal for the IPL’s linear and streaming rights. When Disney+ merged with Hotstar, these rights came along too. (And all those subscribers Disney touted in earnings calls.) This year, there was an auction for the next five years, which started in February and just concluded. Along the way, everyone from Amazon to Disney to even Facebook was interested. (Previously, Apple, Netflix and Google were rumored to be interested.) Yet Viacom18 emerged victorious. 5 Notes About Sports Rights, India and StreamingTrying to make sense of this auction, a handful of ideas stuck out to me as the most important drivers. 1. Winner-takes-all applies in sportsWhen it comes to entertainment, the best performing film, game or TV series isn’t just a pinch bigger than the rest, but multiples bigger. (Think how Avengers: Endgame made more money than the 600 smallest movies released in 2019. Read my article here for details.) This applies to sports too. In the U.S., the NFL is king. In Europe and Latin America, soccer isn’t just king, but some sort of emperor of Rome. In India, the IPL is the market leader. Thus, the frenzy. 2. But — the winner’s curse in auctionsThe more participants you have in an auction, the likelier it is that the winner is going to overpay for the underlying good. This is a well-known economic principle when bidding on something with an unknown future value. Each bidder will have their own estimate of the future value of a good, and the person with the most optimistic assessment will win the bid. But that means that the winner is “cursed” because the average estimate of the crowd is usually correct. Meaning that the most optimistic person likely will overpay. 3. India is a big streaming prize, but less valued than it once wasAbout a decade back, India was going to be the big prize. It was nearly as big as China and was growing almost as rapidly, but crucially, was actually open to outside companies coming in. (Though now I should say, “mostly open.”) Presumably, this means India would have a massive middle class hungry for Western goods and services, and big multi-nationals poured investments into India. And… those optimistic forecasts haven’t really borne out. Yes, India is still huge, but the middle class everyone thought we’d see hasn’t shown up in force. As such, even as almost all the streamers invest heavily in India — the articles about Indian content spend by the streamers are legion — most Indian streaming customers pay a fraction of what they pay in America or Europe (for example, a Disney+ subscription in India that includes Hotstar earns Disney $0.76 in average revenue per user, compared with $6.32 ARPU in the U.S.). So, there is a large body of potential customers, but the average revenue per user drastically trails other markets. Reed Hastings himself even said on an earning call that Netflix’s struggles in India are “frustrating.”   4. New subscribers matter more to new playersIn economics terms, the “marginal benefit” of a new subscriber decreases as a streamer keeps adding subscribers. (And yes, “marginal benefit” is about as “economics 101” as you get.) In streaming, the first few customers will have the most marginal benefit, because they’re the likeliest to subscribe; you have the least cost to acquire them, but they’ll hang around the longest. To get more subscribers, you have to spend more on marketing, which decreases the “marginal benefit.” The implication for the streaming wars is that young streamers looking to get market share — think Netflix circa 2015 — can spend more (and even lose money) to get new subscribers. But once you’ve hit market saturation, losing money makes less sense. But the upstarts can still see the benefits to money-losing strategies. Viacom18 only owns ad-supported streaming, and adding cricket could allow them to add more paying subscribers, to catch up with Disney’s estimated 36 million subscribers or Prime Video’s 17 million. Plus Paramount+ is forecast to launch in India in 2023.   5. Streaming doesn’t make money; financial discipline’s returnEver since Netflix’s stock collapse in April, cost-consciousness has returned to entertainment. But I think everyone has read about that. This is how the market for Netflix looked at yesterday’s close. Today’s not looking much better. Why Did Disney and Amazon Let Viacom18 Win?At first blush, the fact that Disney lost the IPL rights was the most surprising news of this week. While there had definitely been rumors that Disney wouldn’t pony up to win, I didn’t think Disney could really decide to risk its millions of Indian Disney+/Hotstar subscribers by letting IPL cricket go. But as others pointed out, Hotstar still kept the linear rights. In this case, I think Disney didn’t want the curse of winning this bid. They’re the biggest streamer in India, so the marginal benefit of new subscribers isn’t there. (Though they hope they don’t hemorrhage users now.) Not to mention, they still get to keep the linear rights, where they think that traditional ad-sales will generate more reliable revenue. And as Disney has discovered, India isn’t quite the prize folks thought it would be, with those $1 or less subscribers. So how could Viacom18 — a joint venture between several Indian telecom companies and Paramount Global — decide to go all in on IPL rights when Disney bailed? Well, they had the most to gain. For Paramount Global, adding tons of global subscribers, even if on a joint venture, is still the goal. Wall Street may care less about raw subscriber additions, but they still care. Even if they lose money on it, maybe a five-year IPL deal is the spark to build a viable subscriber base in India. Think of it as their potential House of Cards. If you’re going to go all in on sports, IPL in India is the way to do it because it’s the biggest sports league in a growing market. It’s probably more shocking Amazon couldn’t make these numbers work. Everyone always speculates that Amazon has an unlimited pile of cash to spend on whatever they want; well clearly, it’s not that unlimited! Unlike Disney+, and despite spending tons on content, Amazon isn’t really dominant in Indian streaming. But they are established, so Amazon probably looked at spending billions on streaming rights and couldn’t make the numbers work. (To boot, I’ve heard rumblings that Amazon is already looking at the MGM deal and wondering what they really bought. Arguably they’ve already been cursed by winning that auction.) This last point — a tech giant opting out of spending like crazy—could have set the narrative for sports rights, but then Apple announced a big deal for MLS rights. (Though they’ll also set up an MLS streaming subscription, which is slightly different.) They’ve also recently started streaming MLB games and are rumored to be the leader in the next NFL Sunday Ticket rights deal. All to say, with some streamers embracing newfound financial discipline, at least one tech giant is spending like crazy. So will this newfound restraint in India be the new norm, or just a blip in the streaming wars? With NFL’s Sunday Ticket, Formula 1 rights and the NBA looking for a new media rights deal, we’ll see. (If you enjoyed this data dive, check out my other writings over at my newsletter. I recently launched a subscription for my weekly deep dives into streaming ratings. If you want deep looks into who is winning and losing the content wars in streaming, sign up by Friday the 17th of June to lock in my “founders rate”.) New on The Ankler

This post is only for paid subscribers of The Ankler.. |